The UAE Financial Markets Association (UAE FMA) has signed a cooperation agreement with the International Capital Market Association (ICMA) to boost their cooperation and mutual membership as well as to exchange expertise and information on regulatory developments and international best practices in the financial markets sector.

Under the newly signed agreement, both parties will coordinate their efforts to design educational training programs, prepare analytical reports for financial markets, read advanced data, and explore opportunities to improve automated trading technology.

They will also cooperate in effective trading practices, clearing and settlement procedures, and will also work together to share their expertise and experience, with the ICMA briefing the other side on its global financial markets experience.

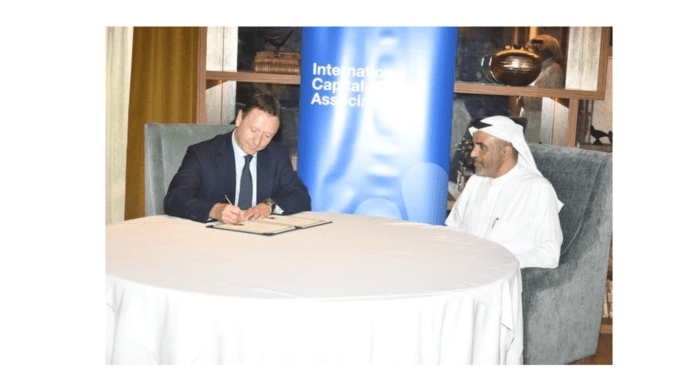

Mohammed Al Hashemi, Chairman of UAE FMA, and Bryan Pascoe, CEO of ICMA, signed the partnership agreement, in the presence of a number of senior officials from both sides.

Expressing his happiness with the promising partnership, Al Hashemi stressed that the agreement comes in line with the UAE FMA’s keenness to expand its network of influential strategic partners with extensive experience in the global financial markets, adding that it will help the association’s members gain new experience and will provide them with the skills and knowledge they need to do business in the global financial markets, while also broadening the scope of investment opportunities for both sides.

Al Hashemi said that the agreement will positively reflect on boosting local investment opportunities and drawing in further foreign capital thanks to the association’s crucial role in giving partners a thorough and integrated view of the capital markets in the GCC countries, thus expanding its operations in cross-border markets and broadening its scope of work beyond local markets.

For her part, Ohoud Al Ali, board member of the UAE Financial Markets Association, emphasized that the UAE FMA looks forward to keeping the influential partners up to date with the latest investment prospects offered by the UAE financial markets, which are provided based on a package of flexible legislative regulations, in addition to briefing the association’s members on partners’ extensive experience and skills.

Bryan Pascoe, on the other hand, underscored that the UAE is one of the best destinations for capital looking to invest in its various sectors, especially in financial markets, now that it offers a safe haven for all types of investments, as evidenced by the rising growth in various sectors. “The agreement will undoubtedly contribute to strengthening the ICMA’s relationship with UAE FMA and expanding the frontiers of joint collaboration to create investment opportunities and bring about greater qualitative leaps in the regional financial markets,” Pascoe said.

Joint Conference

Meanwhile, the UAE FMA co-hosted yesterday (Wednesday) a conference entitled, “Dynamics and Developments in International Repo Markets-A Lens on the Middle East and North Africa” in the presence of the International Capital Markets Association.

The conference featured a series of interactive panel discussions with stakeholders in the local market who discussed opportunities and challenges that repo and guarantees face in the global financial market as well as related opportunities in the Middle East and North Africa region.

The conference kicked off with a presentation by Alexander Westphal, ICMA director, market practice and regulatory policy, in which he addressed the main trends of repo in European markets as well as the settlement system, its efficiency, sustainability, and digitization of buyback.

The conference also featured a presentation by Rahman Janjua, Credit Repo and Secured Financing, First Abu Dhabi Bank, titled “Global and Regional Repo Market Trends,” in which he spoke about regional developments and applications of repo, crucial control points, automation, Islamic repo, and financing versus balance sheet management.

While the second panel discussion focused on automation, digitalization, and legal technology in the financial market sector, another session, in which Dina Saudi, Senior Associate Director of ICMA, participated, covered legal opinions and business, associated advancements like the categorization project, and legal technology.